Income Tax Rebate Form – Income tax rebates are a common subject of interest for many taxpayers. Understanding the ins and outs of the income tax rebate form can lead to significant savings. In this article, we will delve into the details of income tax rebates, the various forms associated with them, and how to make the most of this opportunity.

When it comes to your hard-earned money, every penny saved counts. Income tax rebates are a way for taxpayers to reclaim some of the taxes they’ve paid during the year. These rebates can be a financial lifeline for many individuals, helping them secure a more stable financial future.

Understanding the Purpose of an Income Tax Rebate

The primary purpose of an income tax rebate is to reduce the tax liability of individuals. It aims to provide relief to those who may have overpaid taxes or are eligible for specific deductions. This form of tax relief ensures that taxpayers are not burdened by excessive taxation.

Eligibility Criteria for Income Tax Rebate

Not everyone is eligible for an income tax rebate. Eligibility depends on various factors, including your income, investments, and deductions. It’s essential to be aware of these criteria to make the most of your tax benefits.

Types of Income Tax Rebate Forms

There are various forms related to income tax rebates, each serving a different purpose. Let’s explore some of the most common ones:

- Form 10E for Relief under Section 89(1)

This form is used to claim relief under Section 89(1) for arrears and advance salary. If you’ve received salary in arrears or in advance, this form is crucial for avoiding over-taxation.

- Form 16 for TDS and Salary Income

Form 16 is a document provided by your employer that contains details of your salary, allowances, and deductions. It is essential for calculating your tax liability accurately.

- Form 26AS for Tax Credit

Form 26AS is a statement that provides a summary of the taxes deducted from your income. It’s a crucial reference when filing your income tax return and claiming a rebate.

How to Obtain Income Tax Rebate Forms

Income tax rebate forms are readily available online on the official website of the Income Tax Department. You can easily download the required forms based on your eligibility and needs.

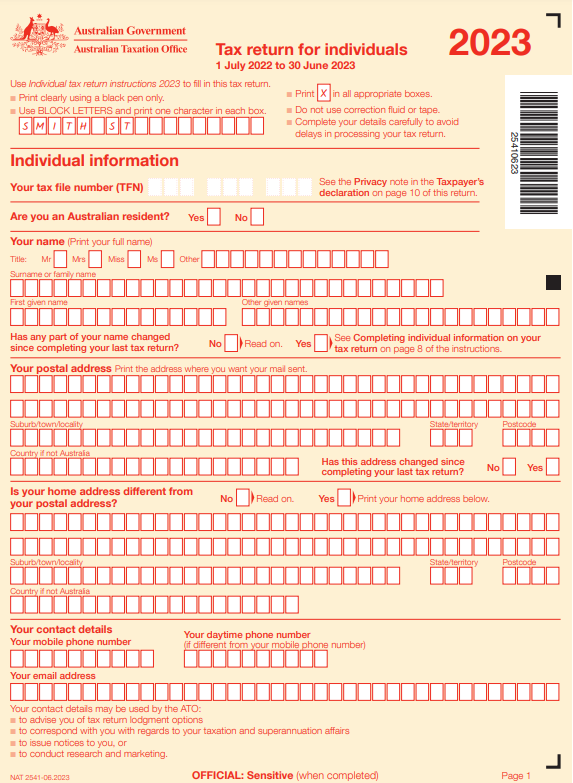

Filling Out the Income Tax Rebate Form

Filling out the income tax rebate form requires careful attention to detail. It’s essential to provide accurate information to ensure a smooth processing of your rebate claim.

Submission Process and Deadlines

Once you’ve filled out the form, you need to submit it within the specified deadlines. Missing the deadline could result in the rejection of your rebate claim.

Common Mistakes to Avoid

Avoid common mistakes such as providing incorrect information, missing deadlines, or not attaching necessary documents. These errors can lead to delays or even the rejection of your rebate application.

Tracking the Status of Your Rebate

After submission, it’s crucial to keep tabs on the status of your rebate. The Income Tax Department provides an online portal for tracking the progress of your claim.

The Importance of Accurate Documentation

Accurate documentation is key to a successful rebate claim. Ensure you have all the necessary documents, such as Form 16, Form 26AS, and other supporting documents, to avoid discrepancies.

Benefits of Filing for Income Tax Rebates

Filing for income tax rebates not only reduces your tax liability but also ensures you receive the money you deserve. It’s a proactive step toward financial stability.

Conclusion

Understanding and utilizing income tax rebate forms is a valuable financial skill. By following the guidelines and staying organized, you can maximize your tax returns and secure your financial future.